what's with the dog?

In 2008, Spark led Twitter’s Series B and made a very dear friend in the process, Twitter’s Co-Founder, Biz Stone.

Over the years, we remained very close. And in 2017, after selling Jelly to Pinterest, Biz decided to think about his next move while working out of Spark’s San Francisco office.

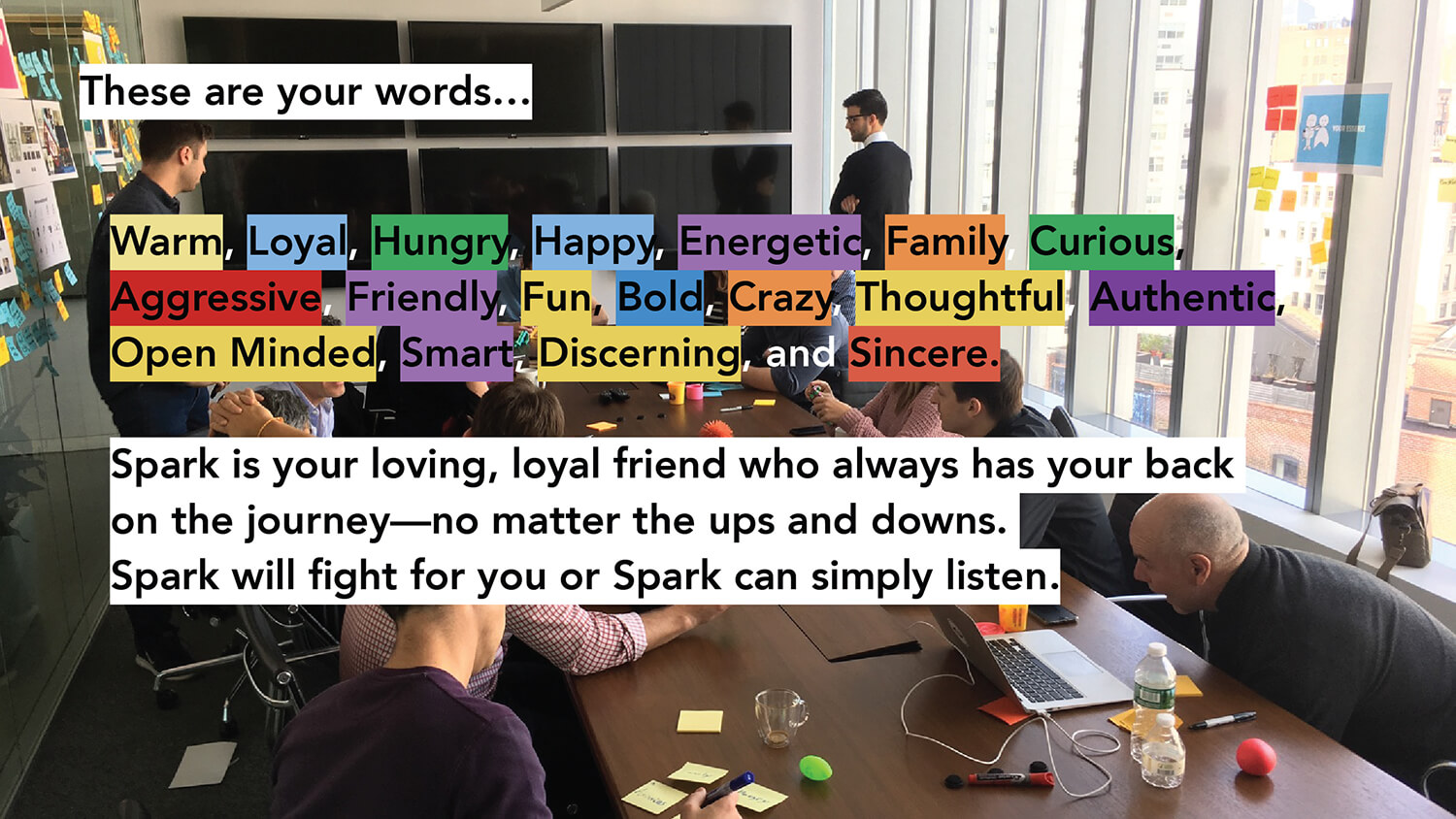

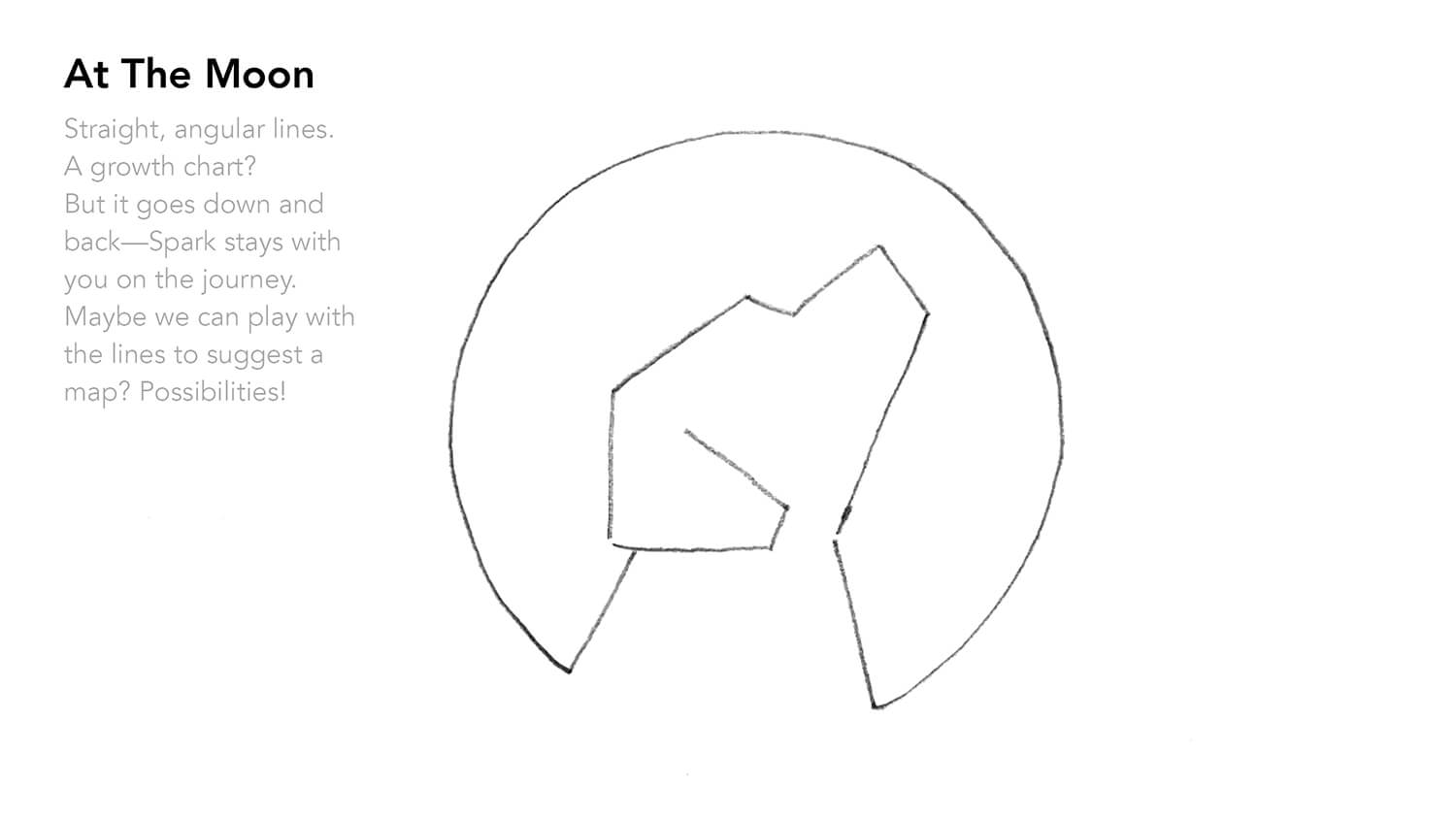

At the same time, Spark was also thinking about its next move, but as a brand. Biz, having worked with us for over a decade, saw an answer for Spark and made us this deck. We loved it. His wit and unbound creativity makes us smile to this day. But as branding goes in venture (hint: it doesn’t go), the deck got tucked away.

In 2020, we decided to take a fresh look at Spark’s identity. This meant going through our archives and delivering the full digital pile—including Biz’s deck—to our design partner, Pentagram.

As we explored Spark’s values, beliefs, and how we show up for our founders, Biz’s work finally clicked (not to mention, he has a track record with animal-based logos).

Pentagram decided to revisit that deck and rework those sketches. And, well, Biz—you were right. A dog is spot-on.